Corporate Governance Report

2024 Corporate Governance Highlights

GT Capital Holdings, Inc. (“GT Capital” or the “Corporation”, and together with its subsidiaries, the “Group”), embraces corporate governance best practices recognized in the Philippines and in the Association of Southeast Asian Nations (“ASEAN”) Region. The Corporation actively develops and implements policies and practices that align with the core principles of corporate governance as outlined in the Securities and Exchange Commission’s (“SEC”) Code of Corporate Governance for Publicly-Listed Companies and Integrated Annual Corporate Governance Report, the G20/ OECD Principles of Corporate Governance, and the ASEAN Corporate Governance Scorecard.

GT Capital’s commitment to advancing its corporate governance policies and business practices has yielded recognition from the investment community, both within the domestic market and throughout the ASEAN region.

As part of its ongoing improvement in corporate governance, GT Capital undertook the following best

practices in 2024:

1. Virtual conduct of the 2024 Annual Stockholders’ Meeting (“ASM”) of the Corporation, in compliance with SEC Memorandum Circular No. 6 Series of 2020, with stockholders having the option to vote through proxy or through electronic voting during the ASM;

2. Re-election of a female independent director;

3. Adoption of an organizational Closed Circuit Television Policy;

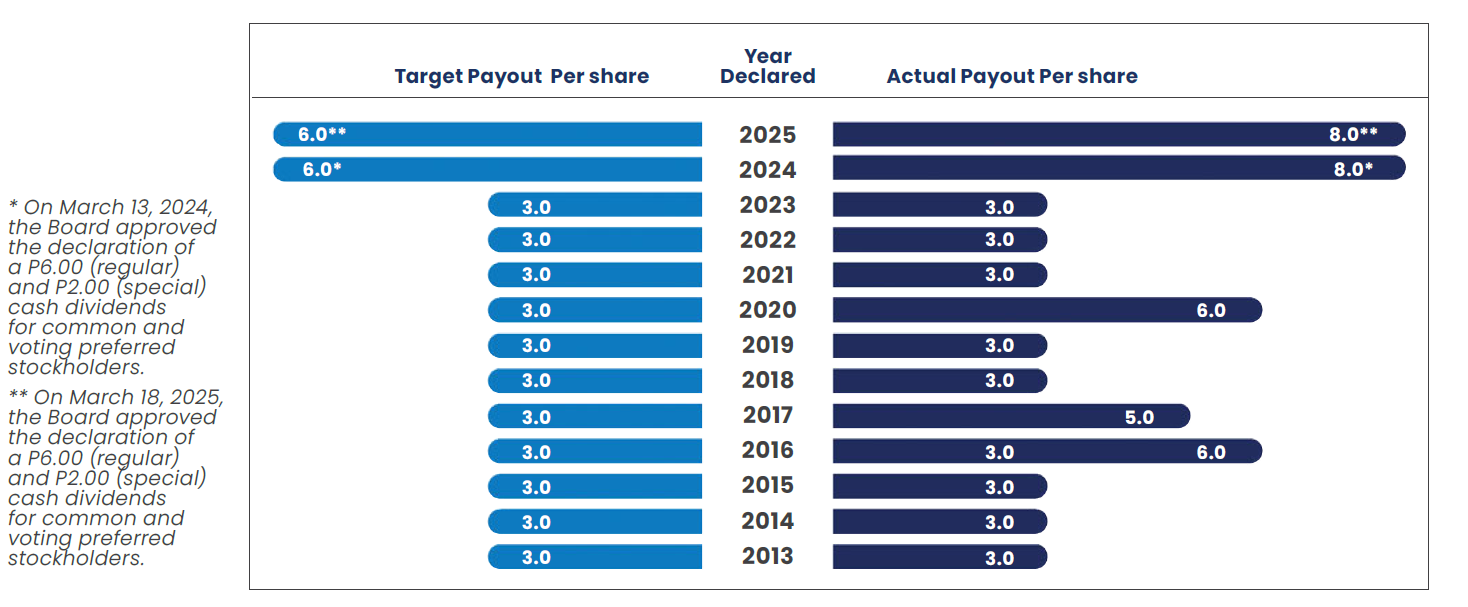

4. Increased the Corporation’s annual target dividend payout from Three Pesos (Php 3.00) per share to Six Pesos (PhP 6.00) per share effective on year 2024;

5. The Risk Oversight Committee (“ROC”) and its Charter has been amended to Risk & Sustainability Oversight Committee (“RSOC”) to formalize the oversight of sustainability within its governance mandate, a responsibility already being fulfilled by the Committee;

6. Continuation of using global disclosure frameworks and standards for Sustainability Reporting, that consolidates the annual report and sustainability report in accordance with the Integrated Reporting Framework, Global Reporting Standards (GRI), and Sustainability Accounting Standards Board (SASB) standards in its public disclosures;

7. Engagement of External Assurance for the public disclosures to provide a fair and balanced representation of GT Capital’s overall performance and its commitment to creating sustainable value for stakeholders;

8. Enhancing the capabilities of the Board of Directors (the “Board”) through the conduct of the Thought Leadership Series, which covers various topics on Environmental, Social, and Governance (ESG);

9. Enhancing the awareness and capabilities of various levels of the organization through the conduct of risk and sustainability culture building activities;

10. Codification of the oversight of the Corporation’s sustainability program under the scope of the Risk and Sustainability Oversight Committee; and

11. Meeting of Non-Executive Directors without any executives present on December 13, 2024.

2024 Compliance

GT Capital is compliant with the Code of Corporate Governance for Publicly-Listed Companies (“PLCs”) as well as with all laws, rules, and regulations pertinent to its business.

As a PLC, GT Capital acknowledges its duty and responsibility to provide timely and accurate information to the investing public. To this end, GT Capital strictly complies with all reportorial and disclosure requirements imposed by regulatory agencies such as the SEC, the Philippine Stock Exchange (“PSE”), and the Philippine Dealing and Exchange Corporation. GT Capital likewise ensures the posting of all reportorial and disclosure requirements onto GT Capital’s website: www.gtcapital.com.ph.

Corporate Governance Policies and Practices

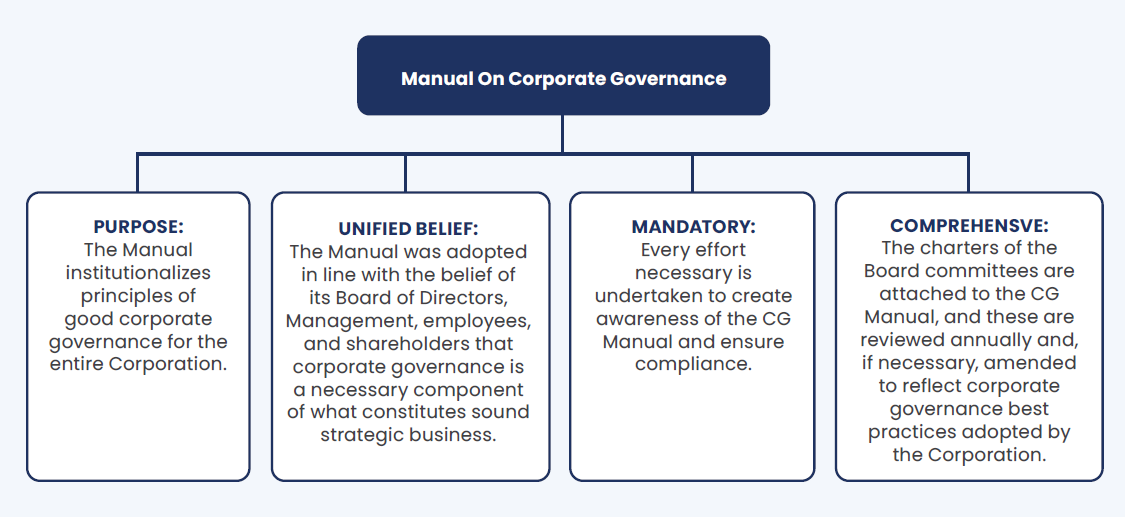

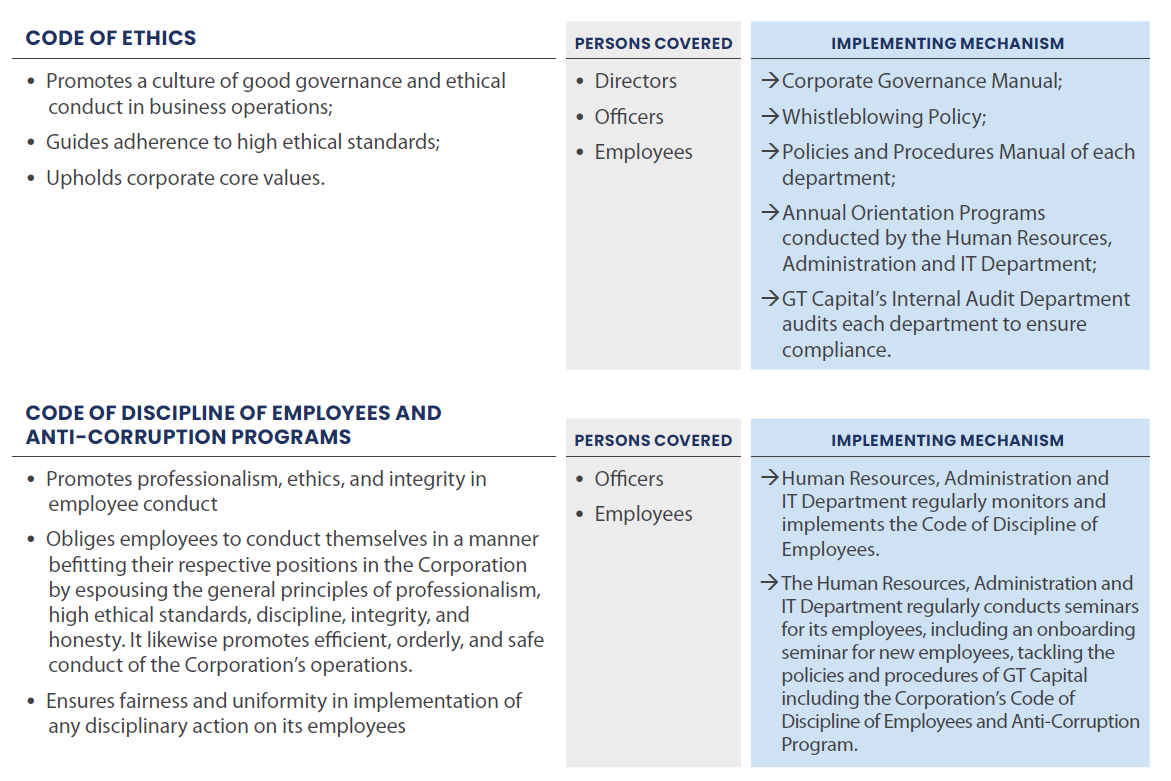

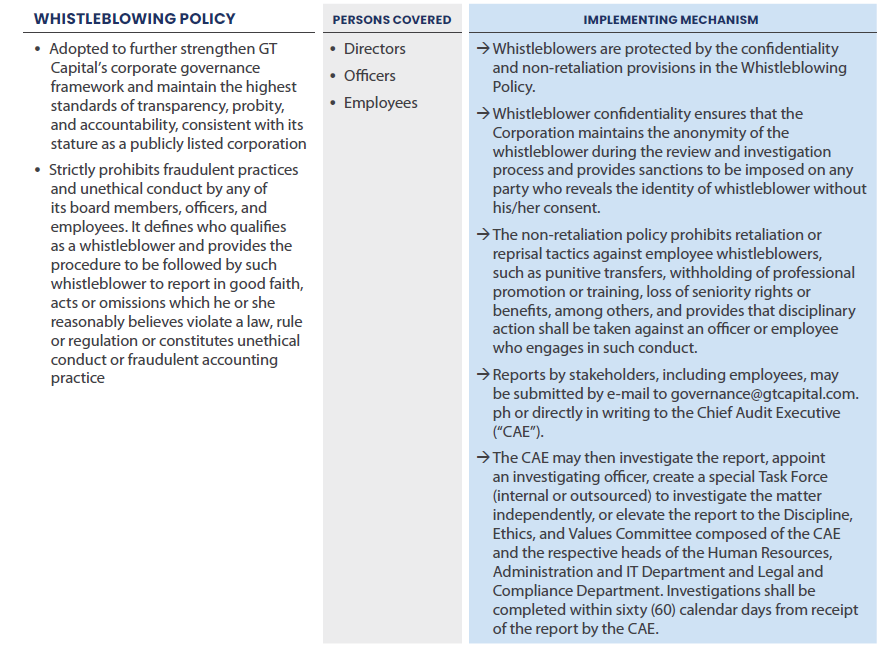

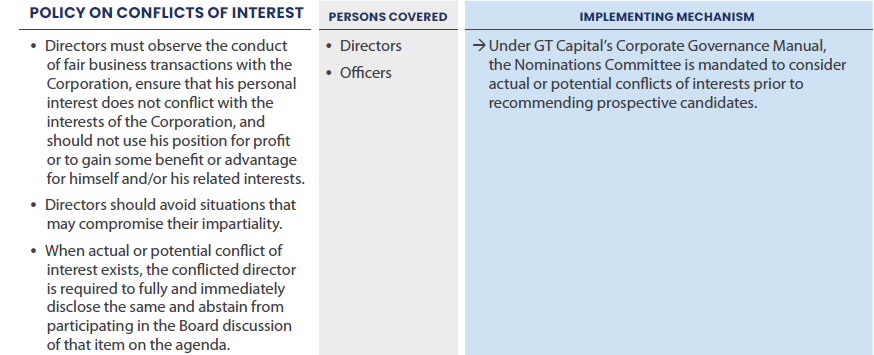

To cultivate a culture of compliance within the Corporation, GT Capital established the following policies in support of its corporate governance framework.

Board of Directors and Management

The Board of GT Capital is responsible for the governance of the Corporation and ensures its compliance with the principles of good governance by providing an independent check on Management. By setting policies for the accomplishment of GT Capital’s corporate objectives, the Board fosters the long-term success, sustained growth, and competitiveness of the Corporation in a manner consistent with its fiduciary responsibility towards both the Corporation and its stakeholders.

Board Composition

The Nominations Committee pre-screens and shortlists all candidates nominated to become a member of the Board. GT Capital’s stockholders elect annually members of the Board from a final list of candidates prepared by the Nominations Committee. In determining the nominees for any vacancy, the Corporation avails of the Board Director Sourcing Services of the Institute of Corporate Directors. The experience of the members of the Board encompasses a wide range of experience in business, finance, and law, as well as expertise in industries in which GT Capital’s operating companies is involved in.

Five (5) members of GT Capital’s Board are Independent Directors. In addition to having all the qualifications and none of the disqualifications as embodied in relevant SEC regulations and in the By-laws of the Corporation, an Independent Director is a person who, apart from his fees and shareholdings, is independent of management and substantial shareholders, and free from any business or other relationship which could, or could reasonably be perceived to materially interfere with his exercise of independent judgment in carrying out his responsibilities as a director.

GT Capital’s CG Manual provides that no director shall simultaneously hold more than five (5) board seats in PLCs, while an executive director shall not serve on more than two (2) boards of PLCs outside the Group. All directors satisfy the foregoing criteria.

The roles of the Chairman and the President are separate to ensure an appropriate balance of power, increase accountability, and improve the Board’s capacity for making decisions separately and independently from Management. Among others, the Chairman ensures that meetings of the Board are in accordance with the By-laws, listens and addresses governance-related issues that may be raised by non-executive or Independent Directors, and ensures that the Board exercises strong oversight over the Corporation and its Management. On the other hand, the President, among other responsibilities, plans, develops, and implements the Corporation’s policies and goals, interfaces with the Chairman to revise objectives and plans in accordance with current conditions, and communicates clearly and directly with employees concerning performance expectations, productivity, and accountability. Mr. Francisco C. Sebastian has served as Chairman of GT Capital since his election on May 11, 2022. Mr. Carmelo Maria Luza Bautista has served as President since GT Capital’s listing in April 2012.

Duties and Responsibilities of the Board

The duties and responsibilities of the Board, which meets at least six (6) times during the year, include: implementing a process for the selection of directors who can contribute independent judgment to the formulation of sound corporate strategies and policies; providing guidelines and insights on major investments and capital expenditures; ensuring the Corporation’s compliance with all relevant laws, regulations and best business practices; establishing and maintaining an Investor Relations Program to keep stockholders apprised of important developments; identifying the stakeholders in the community and formulating a clear policy of communication with them; adopting a system of check and balance with the Board; identifying key risks and performance indicators and monitoring the same; formulating and implementing policies and procedures that would ensure the integrity and transparency of related party transactions; establishing and maintaining an alternative dispute resolution system in GT Capital; constituting committees it deems necessary to assist it in the performance of its functions; and performing such other duties and responsibilities as may be required under the relevant rules and regulations.

Board Attendance

To ensure attendance of directors, the dates of the six (6) regular Board meetings of GT Capital are set before the beginning of the calendar year, one to coincide with the ASM on the second Wednesday of May and four with the financial reports and disclosures during the year (March, May, June, August, November, and December). Another meeting is set for a meeting of non-executive directors without any management present. The quorum requirement for instances when important matters are to be discussed on the agenda, such as issues that will have a significant impact on the character of the Corporation, is two thirds (2/3) of all the directors. In addition, the Board Secretariat ensures the attendance of at least two thirds (2/3) of all the directors for each meeting, regardless of the agenda.

For the year 2024, the Board met six (6) times, and the attendance of each director is provided below:

|

Name and Position |

No. of Meetings Attended |

|

Francisco C. Sebastian Chairman |

6/6 (100%) |

|

Alfred Vy Ty Vice Chairman |

6/6 (100%) |

|

Carmelo Maria Luza Bautista President and Director |

6/6 (100%) |

|

Renato C. Valencia Lead Independent Director |

6/6 (100%) |

|

Rene J. Buenaventura Independent Director |

6/6 (100%) |

|

Consuelo D. Garcia Independent Director |

6/6 (100%) |

|

Gil B. Genio Independent Director |

6/6 (100%) |

|

Carlos G. Dominguez III Independent Director |

6/6 (100%) |

|

Arthur Vy Ty Director |

5/6 (83%) |

|

David T. Go Director |

6/6 (100%) |

|

Regis V. Puno Director |

6/6 (100%) |

The Board, Committee, and Individual Director’s Self-Assessment forms were adopted as a tool for the Corporation to evaluate the performance of its Board, Committees, and individual directors and to assess the efficiency of its processes. These enable the Board and Management to identify areas for improvement and determine the value and contribution of the Board and each director towards the growth and improvement of the Corporation. The Self-Assessment forms are distributed to the members of the Board and tabulated by the Board Secretariat so that results may be reported to and acted upon by the Board, Management, and/or appropriate committee, as necessary.

The criteria for the Self-Assessment of the Board, the Committees, and individual directors are as follows:

| Board Self-Assessment Criteria |

| • Structure and Composition • Roles and Accountability • Board Process • Board Dynamics |

| Director Self-Assessment Criteria |

| • Director Roles & Responsibilities • Vision, Goals and Strategies • Continuous education, development and improvement • Board Meetings • Participation and Overall Performance |

| Committee Self-Assessment Criteria |

| • Charter • Composition and Quality • Meetings • Duties and Responsibilities • Working relationship with executives |

Questions may be answered on a scale ranging from “strongly disagree” to “strongly agree”, and qualitative questions are asked to solicit comments and suggestions on recommended areas of focus and on how to improve the Corporation’s performance

Every three (3) years, the Corporation endeavors, as a matter of policy, to engage an independent external facilitator who will conduct and oversee the assessment process. When the process is overseen by an independent external facilitator, interviews of select directors of the Corporation may be conducted to enable such external facilitator to ask additional questions in relation to the directors’ answers to the Self-assessment forms.

Performance Assessment of President by the Board

The President’s Assessment questionnaire is a tool used to evaluate the performance of the President of GT Capital and to identify areas of improvement. It is distributed to the Board and the results are provided to the President. The Questionnaire is divided into the following sub-sections: leadership, strategy formulation, strategy execution, financial planning/performance, relationship with the Board, personal qualities, transparency/effective communication, and integrity. The Board rated the President on a scale of one (1) as the lowest to five (5) as the highest. The questionnaire also includes a portion on the President’s development needs where the directors can identify the President’s strengths and suggest key result areas and personal development for the coming year.

Board Committees

The Board exercises authority over specific aspects of GT Capital’s business through its committees, which aids in complying with the principles of good corporate governance. Each committee is governed by its own charter, which serves as a guide on its composition, frequency of meetings, and exercise of its powers, duties and responsibilities. The latest version of each committee charter may be downloaded from the GT Capital website.

Executive Committee

GT Capital’s Executive Committee exercises powers and authority of the Board when the Board is not in session, or when it is impractical for the Board to meet. The Executive Committee reports all its actions to the Board, which may revise or alter the same, provided that no rights or acts of third parties are prejudiced. The Executive Committee also guides Management in the evaluation of the acts or courses of action to be taken prior to its endorsement to the Board, if required under the CG Manual and By-laws of GT Capital.

|

Member |

Position Held in Committee |

Meetings Attended |

|

Francisco C. Sebastian |

Chairman (Non-executive Director) |

19/19 |

|

Alfred Vy Ty |

Vice-Chairman (Non-executive Director) |

18/19 |

|

Arthur Vy Ty |

Member (Non-executive Director) |

19/19 |

|

Carmelo Maria Luza Bautista |

Member (Executive Director) |

19/19 |

Compensation Committee

The Compensation Committee is tasked to implement formal and transparent policies and procedures to ensure that compensation of directors and key officers of GT Capital is consistent with the Corporation’s culture, strategy, longterm interests, and the business environment in which it operates.

|

Member |

Position Held in Committee |

Meetings Attended |

|

Renato C. Valencia |

Chairman (Lead Independent Director) |

1/1 |

|

Rene J. Buenaventura |

Member (Independent Director) |

1/1 |

|

Alfred Vy Ty |

Member (Director) |

1/1 |

Nominations Committee

The Nominations Committee defines and assesses Board membership criteria and identifies and develops highly-qualified individuals to take on key Board and Board Committee positions when vacancies occur. The Nominations Committee pre-screens and shortlists candidates nominated to become a member of the Board of GT Capital and other positions requiring Board appointment. It ensures that all nominees possess all of the qualifications and none of the disqualifications provided under existing laws, rules, and regulations, and promotes the Corporation’s policy on diversity, such that no discrimination is made based on gender, age, ethnicity, nationality or background, whether social, cultural, political or religious.

The Nominations Committee considers the Corporation’s vision, mission, corporate objectives, and strategic direction as well as gaps in the skills and competencies of the currently serving directors. In determining whether there are gaps, the Nominations Committee also considers the sectors that GT Capital and its operating companies are in. The Nominations Committee has the option to use an external search agency or external databases in identifying qualified candidates to the Board.

All members of the Nominations Committee are Independent Directors.

|

Member |

Position Held in Committee |

Meetings Attended |

|

Renato C. Valencia |

Chairman (Lead Independent Director) |

4/4 |

|

Gil B. Genio |

Member (Independent Director) |

4/4 |

|

Rene J. Buenaventura |

Member (Independent Director) |

4/4 |

Audit Committee

The Audit Committee exercises oversight responsibility over the financial reporting process, system of internal control, audit process, and the monitoring of compliance with applicable laws, rules, and regulations. It oversees the Corporation’s external and internal auditors and reviews the audit and non-audit fees paid to external auditors.

|

Statement of the Audit and Risk and Sustainability Oversight Committees on Adequacy of GT Capital’s Internal Controls and Risk Management System In compliance with GT Capital’s Manual on Corporate Governance and PSE’s Corporate Governance Guidelines for publicly listed companies, the Audit Committee and the Risk and Sustainability Oversight Committee jointly certify, on behalf of the Board of Directors, the adequacy and effectiveness of the Corporation’s internal controls and risk management system, and hereby attest that the Parent Corporation’s governance, risk management, and control processes are adequately designed and operating effectively relative to its business objectives. Mr. Gil B. Genio Mr. Rene J. Buenaventura |

|

Member |

Position Held in Committee |

Meetings Attended |

|

Gil B. Genio |

Chairman (Independent Director) |

4/4 |

|

Renato C. Valencia |

Member (Lead Independent Director) |

4/4 |

|

Rene J. Buenaventura |

Member (Independent Director) |

4/4 |

|

Regis V. Puno |

Member (Non-executive Director) |

3/4 |

At least one (1) independent director of the Audit Committee has accounting expertise. Mr. Rene J. Buenaventura is certified public accountant.

Risk and Sustainability Oversight Committee

On risk management, the Risk and Sustainability Oversight Committee is responsible for ensuring the creation and implementation of a robust and effective system of identifying, assessing, monitoring, and managing all material and relevant risks to the Corporation and its shareholders. On sustainability, the Risk and Sustainability Oversight Committee is responsible for overseeing the sustainability program of GT Capital towards its mission to “ensure longterm value for our stakeholders by creating a synergistic business portfolio contributing to our nation’s sustainable development”, taking into account economic, environmental, ethical, and social issues material to the Corporation and its stakeholders.

The powers, duties and responsibilities of the Risk and Sustainability Oversight Committee on risk management include, among others, identifying, assessing, and prioritizing business risks; developing risk management strategies; and overseeing the implementation as well as reviewing and revising GT Capital’s Risk Management Plan. In addition, the Risk and Sustainability Oversight Committee’s powers, duties and responsibilities include, among others, overseeing GT Capital’s material environmental and social issues, providing guidance in the company’s sustainability framework, strategy and policies; overseeing sustainability initiatives and targets; and reviewing the company’s sustainability report.

|

Member |

Position Held in Committee |

Meetings Attended |

|

Rene J. Buenaventura |

Chairman (Independent Director) |

4/4 |

|

Renato C. Valencia |

Member (Lead Independent Director) |

4/4 |

|

Gil B. Genio |

Member (Independent Director) |

4/4 |

|

David T. Go |

Member (Non-executive Director) |

4/4 |

|

Consuelo D. Garcia |

Member (Independent Director) |

4/4 |

Corporate Governance and Related Party Transactions Committee

The Corporate Governance and Related Party Transactions Committee was created as a board-level committee in order to aid the Board in its primary responsibility for good corporate governance. It is tasked with ensuring the Board’s effective and due observance of corporate governance principles and guidelines. The Corporate Governance and Related Party Transactions Committee is also responsible for reviewing transactions with related parties which involve disbursements of funds exceeding the amount provided in the Corporate Governance and Related Party Transactions Committee Charter. In all cases, the Corporate Governance and Related Party Transactions Committee take into consideration the best interest of the Corporation and its shareholders.

The policies which guide the Corporate Governance and Related Party Transactions Committee are found in the Corporate Governance and Related Party Transactions Committee Charter.

One of the policies outlined in the Corporate Governance and Related Party Transactions Committee Charter is the Corporation’s policy prohibiting loans to directors except when the following conditions are present: (a) Management has, based on the judgment of the Board, sufficiently justified the loan or assistance to the related party; (b) the loan or assistance shall be provided on arm’s length basis;

and (c) the terms and conditions of the loan do not deviate substantially from market terms and conditions and do not jeopardize the best interest of the Corporation.

|

Member |

Position Held in Committee |

Meetings Attended |

|

Renato C. Valencia |

Chairman (Lead Independent Director) |

2/2 |

|

Gil B. Genio |

Member (Independent Director) |

2/2 |

|

Rene J. Buenaventura |

Member (Independent Director) |

2/2 |

In 2024, all related party transactions were conducted fairly and at an arm’s length basis. Further discussion on the related party transactions of the Corporation can be found under Note 27 of the Corporation’s Audited Financial Statements.

Board and Committee Support

GT Capital’s Corporate Secretary, Atty. Antonio V. Viray, has extensive experience in legal and company secretarial practices, and, together with Assistant Corporate Secretaries, Ms. Jocelyn Y. Kho and Atty. Ma. Sofia A. Lopez, plays a significant role in supporting the Board by ensuring the efficient flow of information among the Board, Management, stockholders, and stakeholders. They ensure that directors have reasonable access to any information they might need to deliberate on all matters on the Board’s agenda and receive the requisite board materials at least five (5) business days before each meeting.

By keeping abreast with relevant laws, rules and regulations, and industry developments necessary for the performance of their duties and responsibilities, they effectively advise the Board on significant issues as they arise. In monitoring regulatory compliance, they may take appropriate corrective measures to address all regulatory issues and concerns.

Director and Executive Compensation

GT Capital’s Compensation Committee is tasked with ensuring that competitive remuneration is offered to attract and retain the services of qualified and competent directors and officers. Annual compensation of directors and corporate officers of the Board are determined prior to the start of their term. The Human Resources, Administration and IT Department implements policies on compensation and benefits of employees found in its PPM, which sets forth benefits offered by the Corporation as well as the employees entitled to such benefits.

In 2024, GT Capital directors received aggregate remuneration as follows:

|

Remuneration Item |

Executive Directors |

Non-Executive Directors (other than independent directors) |

Independent Directors |

|

Per Diem Allowance |

PhP 1.70 million |

PhP 10.10 million |

PhP 9.20 million |

|

Bonuses |

PhP 0.95 million |

PhP 5.95 million |

PhP 5.50 million |

|

Transportation |

- |

PhP 0.53 million |

PhP 2.86 million |

Remuneration of directors (including Independent and Non-Executive Directors) consists of per diem and transportation allowances as well as a year-end bonus which is not dependent on performance. Directors do not receive any remuneration in the nature of options or performance shares.

Audit and Accounting

Internal Audit

The Internal Audit function of GT Capital is under the responsibility of its Chief Audit Executive (the “CAE”), Ms. Cheryll Sereno. Prior to the start of the year, a risk-based audit plan is prepared, which is then approved by the Audit Committee. Progress of the plan as well as significant audit findings are reported quarterly to the Audit Committee and Board.

The CAE ensures that risk-based audit plans are prepared at the component company level. Progress of these plans and significant audit findings meeting the Group’s escalation criteria are reported by each component company’s Internal Audit Head to the CAE on a quarterly basis. These reports are consolidated and reported to GT Capital’s Management, Audit Committee, and Board.

As mandated by the Internal Audit Charter, to maintain the independence of the internal audit process, the CAE functionally reports to the Audit Committee and administratively to the President. The Audit Committee is thus responsible for the appointment, performance evaluation, and removal of the CAE.

Independent Public Accountants

SyCip Gorres Velayo & Co. (SGV & Co.) was GT Capital’s external auditor for the calendar year 2024. GT Capital is compliant with SRC Rule 68, Paragraph 3 (b) (ix) (Rotation of External Auditors), which states that the independent auditors, or in the case of an audit firm, the signing partner, shall be rotated after every five (5) years of engagement, with a two-year cooling off period to be observed in the re-engagement of the same signing partner or individual auditor. The following SGV & Co. partners were engaged by GT Capital since its listing in 2012.

|

Year |

SGV partner engaged |

|

2012 |

Aris C. Malantic |

|

2013-2017 |

Vicky Lee Salas |

|

2018-2019 |

Miguel U. Ballelos, Jr. |

|

2020-2021 |

Vicky Lee Salas |

|

2022-2024 |

Miguel U. Ballelos, Jr. |

The following table sets out the aggregate fees for audit and audit-related services rendered by SGV & Co. to GT Capital, inclusive of out-of-pocket expenses, but exclusive of value added tax for each of the years ended December 31, 2023 and 2024:

|

|

2023 |

2024 |

|

Audit and Audit-Related Services |

2.32 |

2.44 |

|

Non-Audit Services |

0.05 |

0.05 |

|

Total |

2.38 |

2.49 |

Audit services rendered include the audit of the financial statements and supplementary schedules for submission to SEC, and review of annual income tax computation. Nonaudit services were also provided by SGV & Co. for validation of stockholders’ votes during the ASM. For 2024, the Non- Audit Fees did not exceed the fees for Audit and Audit Related Services.

The Audit Committee has the primary responsibility of recommending to the Board the appointment, reappointment or removal of the external auditor, and the fixing of the audit fees. The Board and stockholders approve the Audit Committee’s recommendation.

Appointment of Independent Party

For the year 2024, GT Capital was not involved in any mergers, acquisitions and/or takeovers which required stockholders’ approval. As such, it was not necessary to appoint an independent party to evaluate the fairness of any transaction price in relation to such mergers, acquisitions, and/or takeovers requiring stockholders’ approval.

Financial Reporting

GT Capital’s financial statements comply with Philippine Accounting Standards and Philippine Financial Reporting Standards and are submitted and disclosed in compliance with the applicable laws, rules and regulations. GT Capital did not revise its financial statements in 2024.

Ownership Structure

Stockholders holding more than 5% of outstanding shares

As of December 31, 2024, the following are the owners of GT Capital’s common stock in excess of five percent (5%) of its total outstanding shares:

|

Record Owner |

No. of Shares Held |

Percentage ( % ) |

|

Grand Titan Capital Holdings, Inc. |

120,413,658 |

55.932% |

|

PCD Nominee Corp. (Filipino) |

50,909,820 |

23.648% |

|

PCD Nominee Corp. (Non-Filipino) |

43,025,466 |

19.985% |

No director or officer has shareholdings in GT Capital amounting to five percent (5%) or more of its outstanding capital stock and there are no cross or pyramid shareholdings.

Direct and Indirect Shareholdings of Major Shareholder, Directors and Senior Officers

GT Capital reports quarterly to the PSE the direct and indirect shareholdings of its major shareholder, Grand Titan Capital Holdings, Inc., GT Capital’s directors, and its senior officers. Their direct and indirect common shareholdings for the year 2024 are as follows:

*

|

Name |

Nature of Relationship to GT Capital |

Number of Shares Directly Owned (As of January 1, 2024) |

Number of Shares Indirectly Owned (As of January 1, 2024) |

Number of Shares Directly Owned (As of December 31, 2024) |

Number of Shares Indirectly Owned (As of December 31, 2024) |

|

Grand Titan Capital Holdings, Inc. |

Principal Shareholder |

120,413,658 (55.932%) |

0 (0.0000%) |

120,413,658 (55.932) |

0 (0.0000%) |

|

Francisco C. Sebastian |

Chairman |

112 (0.0%) |

173,802 (0.081%) |

112 (0.0%) |

173,802 (0.081%) |

|

Alfred V. Ty |

Vice Chairman |

111,780 (0.052%) |

25,299 (0.012%) |

111,780 (0.052%) |

25,299 (0.012%) |

|

Carmelo Maria Luza Bautista |

President and Executive Director |

1,118 (0.0005%) |

26,103 (0.012%) |

1,118 (0.0005%) |

26,103 (0.012%) |

|

Arthur Vy Ty |

Director |

111,780 (0.052%) |

13,149 (0.006%) |

111,780 (0.052%) |

13,149 (0.006%) |

|

Renato C. Valencia |

Lead Independent Director |

218 (0.0%) |

0 (0.0%) |

218 (0.0%) |

0 (0.0%) |

|

Rene J. Buenaventura |

Independent Director |

112 (0.0%) |

0 (0.0%) |

112 (0.0%) |

0 (0.0%) |

|

Consuelo D. Garcia |

Independent Director |

0 (0.0%) |

1,000 (0.0004%) |

0 (0.0%) |

1,000 (0.0004%) |

|

Gil Be Genio |

Independent Director |

0 (0.0%) |

9,810 (0.0045%) |

0 (0.0%) |

9,810 (0.0045%) |

|

Carlos G. Dominguez III |

Independent Director |

0 (0.0%) |

100 (0.0%) |

0 (0.0%) |

100 (0.0%) |

|

David T. Go |

Director |

112 (0.0%) |

0 (0.0%) |

112 (0.0%) |

0 (0.0%) |

|

Regis V. Puno |

Director |

112 (0.0%) |

2,000 (0.0009%) |

112 (0.0) |

2,000 (0.0009%) |

|

Anjanette T. Dy Buncio |

Treasurer |

0 (0.0%) |

176,856 (0.082%) |

0 (0.0%) |

176,856 (0.082%) |

|

Alesandra T. Ty |

Assistant Treasurer |

0 (0.0%) |

21,794 (0.0101%) |

8,387 (0.0039%) |

13,407 (0.0062%) |

|

Antonio V. Viray |

Corporate Secretary |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

|

Jocelyn Y. Kho |

Assistant Corporate Secretary |

0 (0.0%) |

14,080 (0.007%) |

0 (0.0%) |

14,080 (0.007%) |

|

Maria Sofia A. Lopez |

Assistant Corporate Secretary |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

|

Vicente Jose S. Socco |

Executive Vice President |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

|

George S. Uy-Tioco, Jr. |

Senior Vice President/Chief Financial Officer |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

370 (0.0002%) |

|

Jose B. Crisol, Jr. |

Senior Vice President and Head, |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

|

Reyna Rose P. Manon-Og

|

Senior Vice President, Controller/Head Accounting & Financial Controll |

0 (0.0%)

|

1,024 (0.0005%)

|

0 (0.0%) |

1,024 (0.0005%) |

|

Joyce B. De Leon |

First Vice President and Chief Risk Officer |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

1,700 (0.0008%) |

|

Stephen John S. Comia

|

First Vice President and Head of Property Management |

0 (0.0%)

|

1,140 (0.0005%)

|

0 (0.0%) |

1,140 (0.0005%) |

| Susan E. Cornelio | Vice President and Head, Human Resources and Administration |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

| Renee Lynn Miciano-Atienza | Vice President and Head, Legal & Compliance Department |

0 (0.0%) |

50 (0.0%) |

0 (0.0%) |

50 (0.0%) |

|

Don David C. Asuncion

|

Vice President |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

|

Cheryll B. Sereno |

Vice President/ Chief Audit Executive |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

|

Farrah Lyra Q. De Ala |

Assistant Vice President |

0 (0.0%) |

509 (0.0002%) |

0 (0.0%) |

959 (0.0004%) |

|

Rachel Anne R. De Leon |

Assistant Vice President |

0 (0.0%) |

47 (0.0%) |

0 (0.0%) |

47 (0.0%) |

|

Bruce Ricardo O. Lopez |

Assistant Vice President |

0 (0.0%) |

333 (0.0001%) |

0 (0.0%) |

333 (0.0001%) |

Succession Planning

In line with GT Capital’s initiative to strengthen succession planning, the company implemented targeted developmental interventions for officers and employees in 2024. These interventions were designed based on the results of individual competency assessments, ensuring a structured and customized approach to talent development. The programs focused on addressing identified competency gaps, enhancing leadership capabilities, and equipping employees with the necessary skills to take on greater responsibilities within the organization and address strategic business needs. Through this strategic initiative, GT Capital aims to build a robust leadership pipeline and sustain long-term business growth by preparing high-potential employees for future leadership roles.

Creditor Protection

The PPM of the Accounting and Financial Control Department outlines GT Capital’s policies on creditor protection, which ensure timely payment and compliance with loan covenants, such as the maintenance of various financial ratios. These policies were applied in the review of GT Capital’s loan agreements in 2024. The prospectus of each of GT Capital’s existing corporate fixed rate bonds also includes provisions for the protection of bondholders, including the appointment of a trustee bank to act in their behalf. In addition, GT Capital’s loan agreements include provisions on the disclosure of information to lenders, including the Corporation’s financial statements.

The Treasury and Finance Officer monitors all loan provisionsto ensure timely payment of interest and/or principal and works in close coordination with the Legal and Compliance Officer to monitor the Corporation’s compliance with its loan covenants.

Shareholder Meeting and Dividend Policy

The By-laws of GT Capital provides for the second Wednesday of May of every year as the date of the ASM. The notice of ASM, including the details of each agenda item, is released through a disclosure to the PSE at least twentyeight (28) days before the date of the ASM. The notice of ASM includes the agenda, the record date, the date, time and place of the ASM, and the procedure for validation of proxies. The submission of proxies must be done at least five (5) business days prior to ASM. In accordance with the provisions of the Revised Corporation Code of the Philippines, each outstanding common and voting preferred share of stock entitles the holder as of record date to one vote.

From 2013 up to 2023, it was the policy of GT Capital to target an annual dividend payout of at least Three Pesos (Php 3.00) per share, payable from its unrestricted retained earnings. Beginning 2024, GT Capital increased this annual target dividend payout to Six Pesos (Php 6.00) per share. The historical dividend payments detailed below demonstrate the Corporation’s adherence to its relevant dividend target:

Other Stakeholder and Investor Relations

GT Capital recognizes and values its fiduciary duty towards its investors. Crucial to the establishment and maintenance of the trust and confidence of its investors is transparency in systems and communications. GT Capital’s Investor Relations, Strategic Planning, and Corporate Communication (“IRSPCC”) Department aims to impart a thorough understanding of GT Capital’s strategies in creating shareholder value.

The IRSPCC Department compiles and reports relevant documents and requirements to meet the needs of the investing public, shareholders, and other stakeholders of GT Capital, fully disclosing these to the local stock exchange, as well as through quarterly media and analysts briefings, one-on-one investor meetings, the ASM, road shows, investor conferences, e-mail correspondences or telephone queries, teleconferences, its annual and quarterly reports, and GT Capital’s website. All shareholders, including institutional investors, are encouraged to attend stockholders’ meetings and other events held for their benefit.

E-mail inquiries from the investing public and shareholders are received by GT Capital’s IRSPCC Department through IR@gtcapital.com.ph. Correspondence may also be addressed to:

JOSE B. CRISOL, JR.

Senior Vice President

Head, Investor Relations, Strategic Planning, and Corporate Communication

T: (632) 8836 4500

E: jose.crisol@gtcapital.com.ph

SHERMAINE N. CHAVEZ

Deputy Head, Investor Relations, Strategic Planning, and Corporate Communications

T: (+632) 8836 4500

E: shermaine.chavez@gtcapital.com.ph

Other stakeholder concerns may be sent to

governance@gtcapital.com.ph

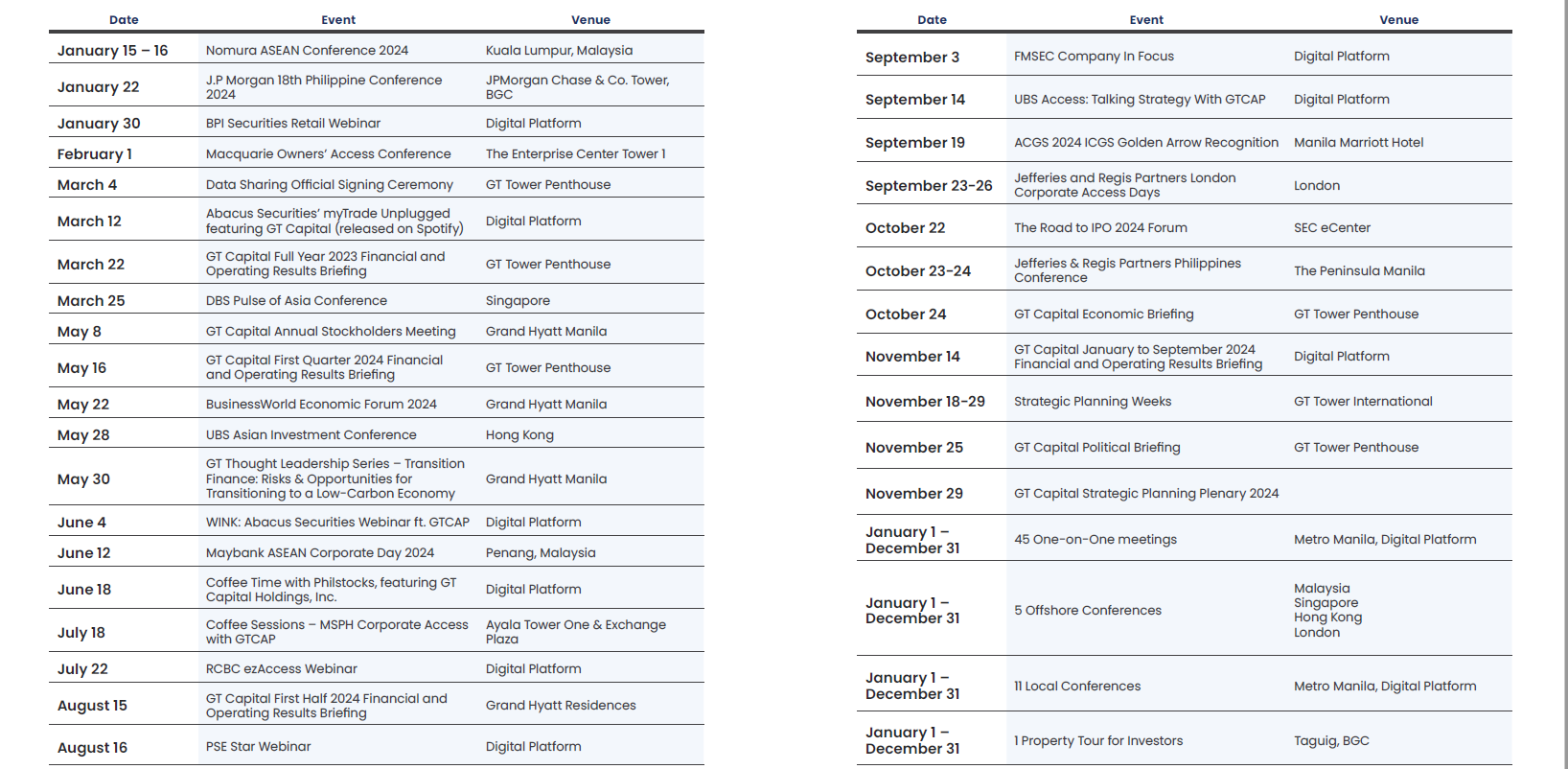

Investor Relations Calendar of Events