Enterprise Risk Management

Risk Management in Context

The risk-taking of a holding company is linked to and largely driven by the risk exposures of its operating companies, which are the primary source of revenue. GT Capital’s Risk Management practice is designed to anticipate potential risks in the various businesses it invests in, identifying risks in the business landscape. The Risk Taxonomy of the organization covers the external risk drivers which influences the exposure to certain types of risks the company has identified as material. External drivers are classified under (a) Economic (b) Regulatory (c) Industry Specific Developments (d) Geopolitical (e) Environmental or Climate Risk and (f) Digital Economy. The process cultivates a forward-looking and proactive mindset for risk managers within the group.

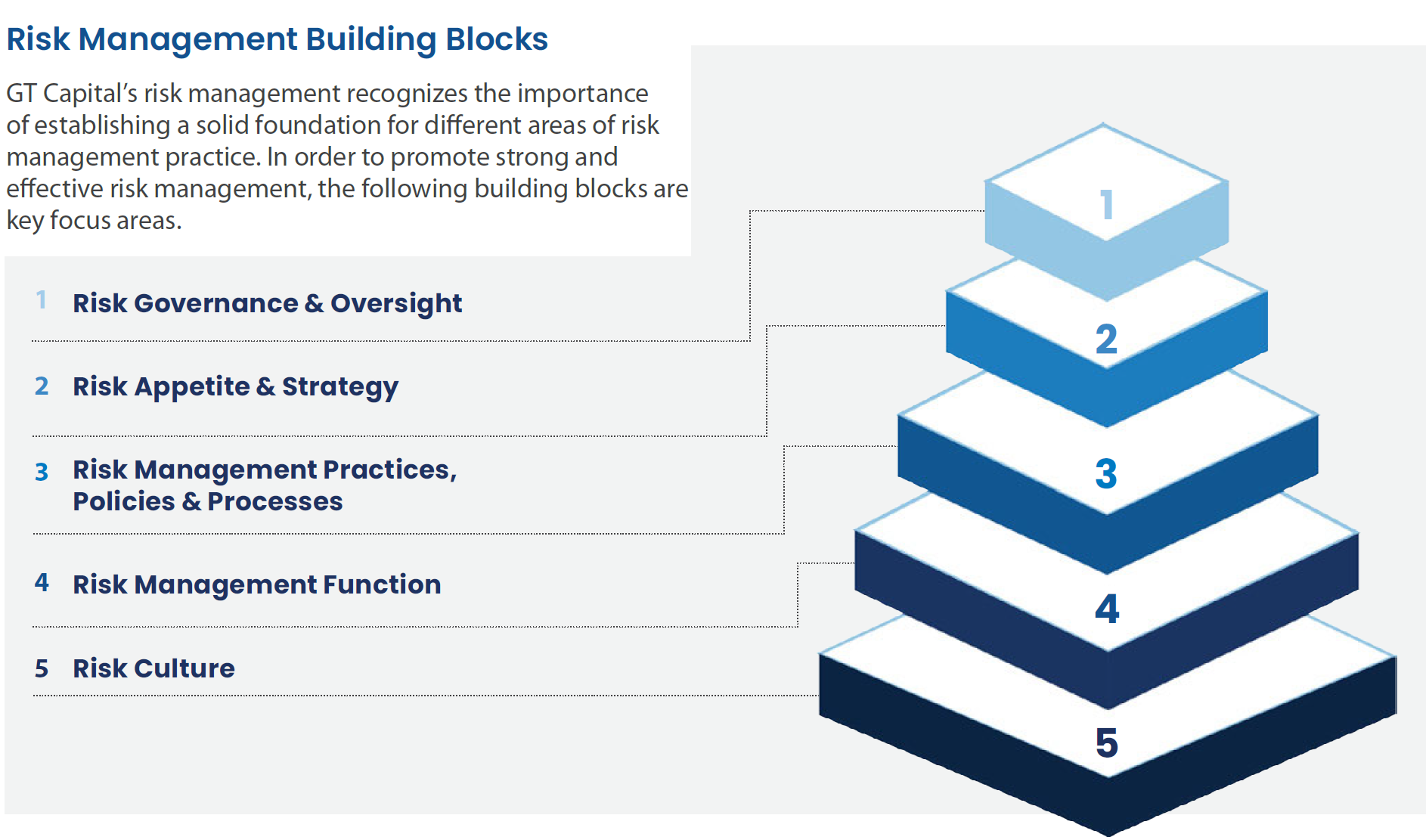

Enterprise Risk Management Standards

GT Capital has adopted an Enterprise Risk Management (“ERM”) Policy and Framework for the promotion for risk awareness, minimization of GT Capital’s exposure to financial losses, and boosting shareholder confidence. GT Capital seeks to maintain an effective risk management process, designed to meet the requirements of good corporate governance.

The goal of the enterprise risk management process is to apply a consistent methodology to identify, assess, and manage business risks across GT Capital. GT Capital undertakes regular assessment of its risks using methodologies aligned with global risk management standards - ISO 31000 and COSO Framework.

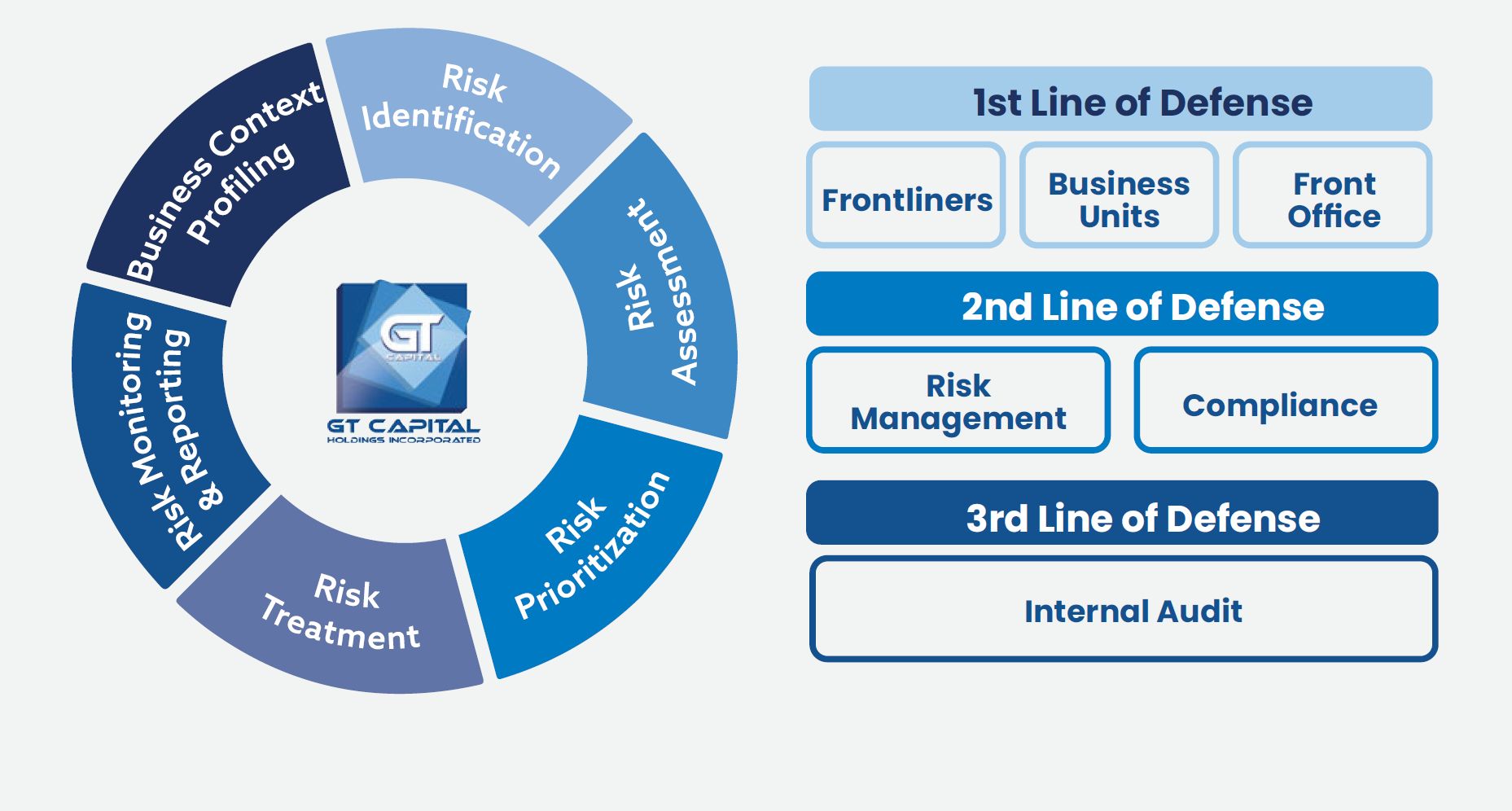

Enterprise Risk Management Process

The company follows the three lines of defense model integrating risk management in the day-to-day activities of the business. All employees are trained and expected to participate and be responsible in the implementation of the Enterprise Risk Management Process which is comprised of the following steps. Moreover, risk management is included in the investment due diligence process in ensuring that the proper risks are accounted for before any potential investments.

Risk Management Process

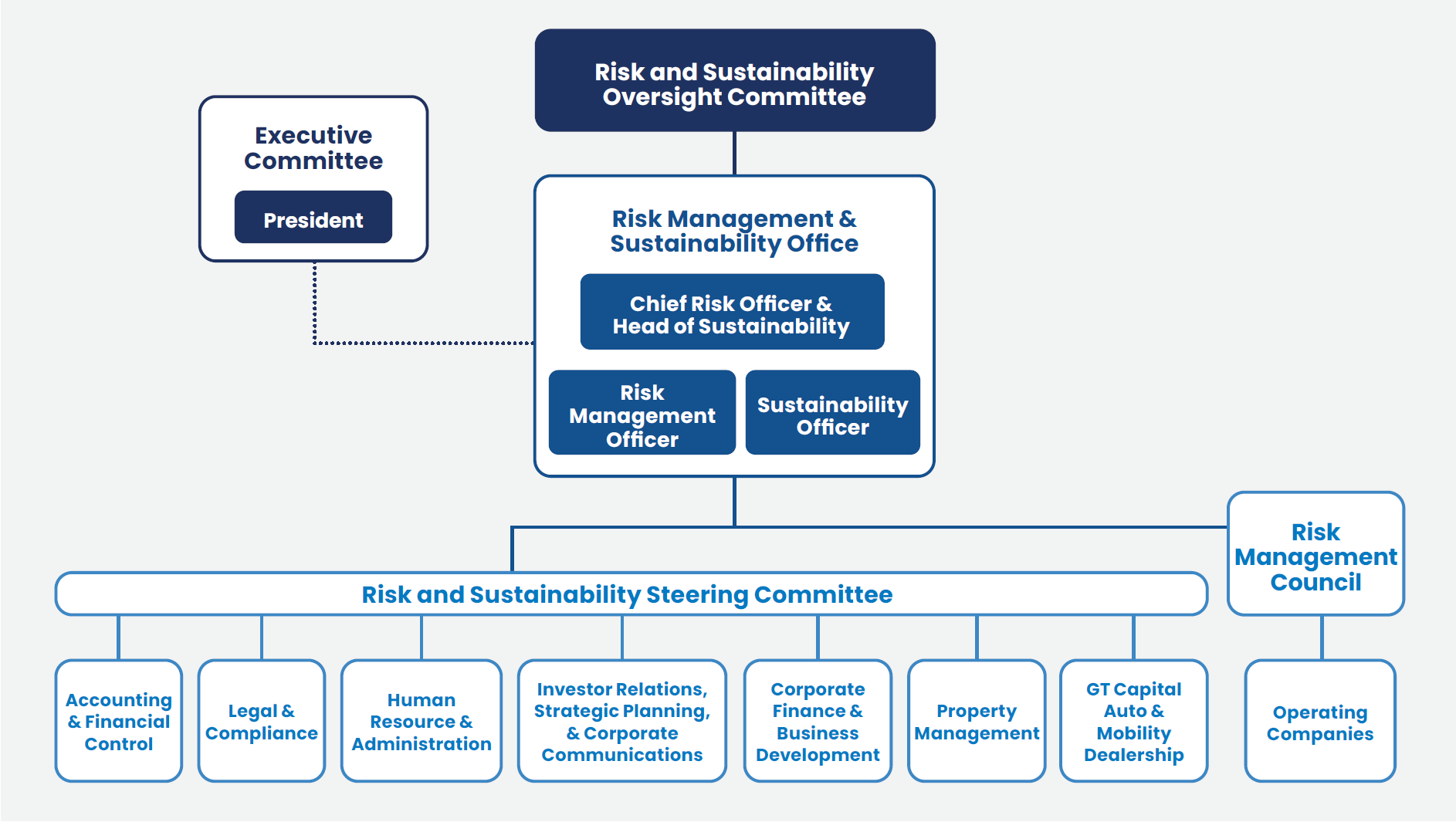

Risk Governance Structure

GT Capital’s risk governance structure ensures that risk management is not the sole responsibility of one individual but rather occurs and is supported at all levels in the Corporation. The effectiveness of the risk governance structure and process is supported by well-defined risk management roles and responsibilities and periodic review conducted by the Internal Audit Department. The Risk and Sustainability Oversight Committees (“RSOC”) meetings are performed on a quarterly basis covering the group’s risk exposures including its operating companies.

Risk Governance

The Board of Directors, through the Risk and Sustainability Oversight Committee (“RSOC”), has the ultimate oversight role over the Corporation’s risk management activities, and approves risk management-related policies, procedures, and parameters that govern the management of risks.

The Board of Directors, with guidance from the Executive Committee, determines the strategic direction of GT Capital and creates the environment and the structures to properly align risk management with strategic objectives.

The Chief Risk Officer (“CRO”) is the enterprise-wide risk advocate who facilitates the execution of the ERM process. The primary responsibility is to own, develop, implement, and continuously improve the ERM process. He is assisted by a full-time risk management officer.

The Risk & Sustainability Steering Committee (“RSSC”) members are composed of heads of departments at the parent level who are responsible for the oversight of risk exposures across the group and the strategic risk management for the portfolio of investments.

The Risk Management Council members are composed of representatives from the operating companies who serve as champions for the identification, assessment, and monitoring of key risks, and the establishment of countermeasures in collaboration with the business units.

The Internal Audit Department provides an independent assurance of the effectiveness of the risk management process. In accordance with the Risk Management Charter, the risk management system is subjected to regular internal audits to identify any gaps in the performance of the process. The audit results are reported to Senior Management, the Audit Committee, and the Risk & Sustainability Oversight Committee, and are addressed accordingly.

In December 2024, the Internal Audit Department (IAD) performed an audit on the Enterprise Risk Management Framework’s implementation and controls which resulted in an overall rating of satisfactory indicating that controls are in place and performing as designed. Furthermore, a joint statement is signed and approved by the Board on the adequacy and effectiveness of the Corporation’s internal controls and risk management system. The enterprise risk management process is expected to be audited once every two years based on the internal audit’s risk assessment.

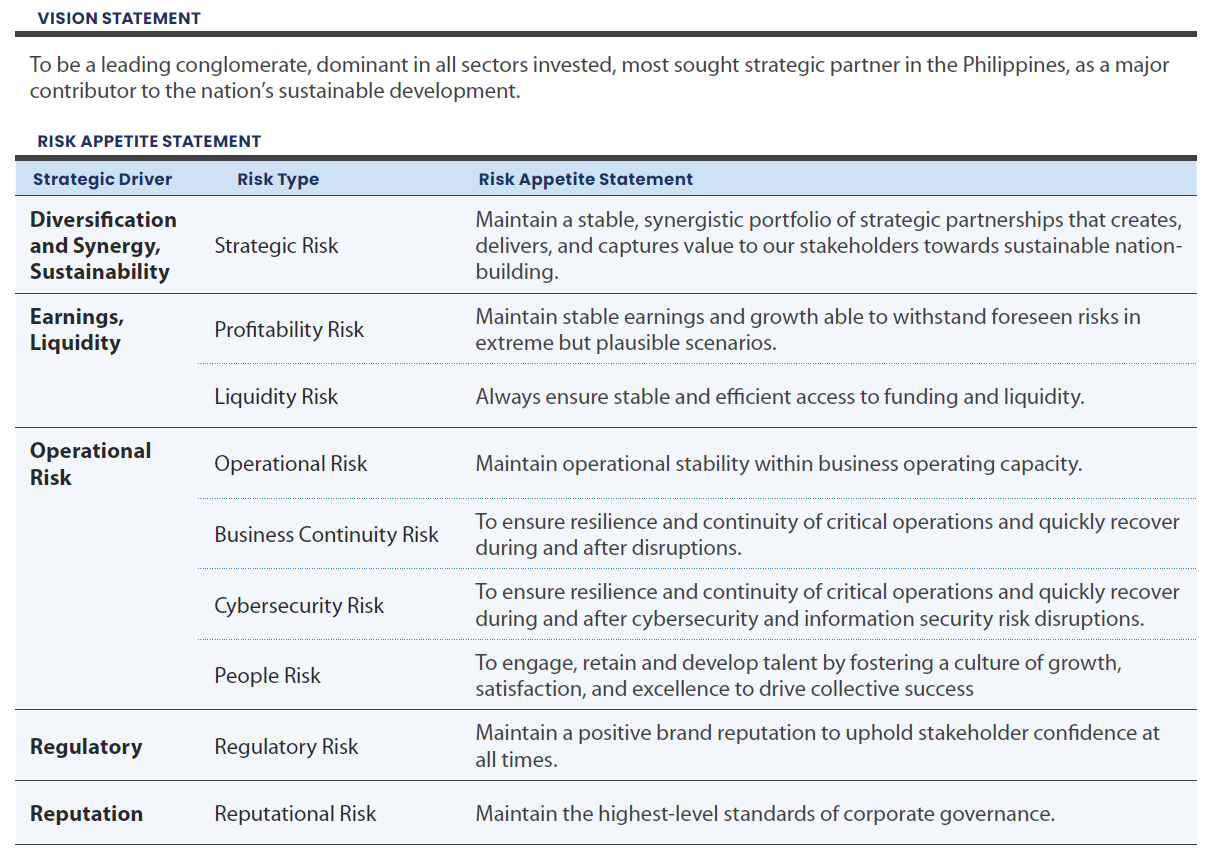

Risk Appetite & Strategy

Risk Management’s goal is to provide reasonable assurance regarding the company’s achievement of its core objectives of optimizing risk and return. To be value creating and effective, Risk Management must be embedded in and connected directly to the enterprise’s strategic planning process and execution. Aligned to this, the Risk Appetite Statements, with specific guiding thresholds and key metrics are reviewed and approved by the RSSC and RSOC on an annual basis.

Risk Management Culture

Creating and promoting a risk culture that requires the highest standards of ethical behavior among all personnel is a must. This is achieved through the following:

- Transparent and consistent policies aligned with the risk appetite statements

- Pro-active engagement of first line of defense in risk management actions

- Promoting awareness among employees via culture building activities

- Onboarding process for employees

- Risk management KPIs in employee performance review

- Continuing education for all levels of the organization including the Senior Management and the Risk and Sustainability Oversight Committee members

- Synergize learning opportunities across the Group for risk management

RISKS AND OPPORTUNITIES

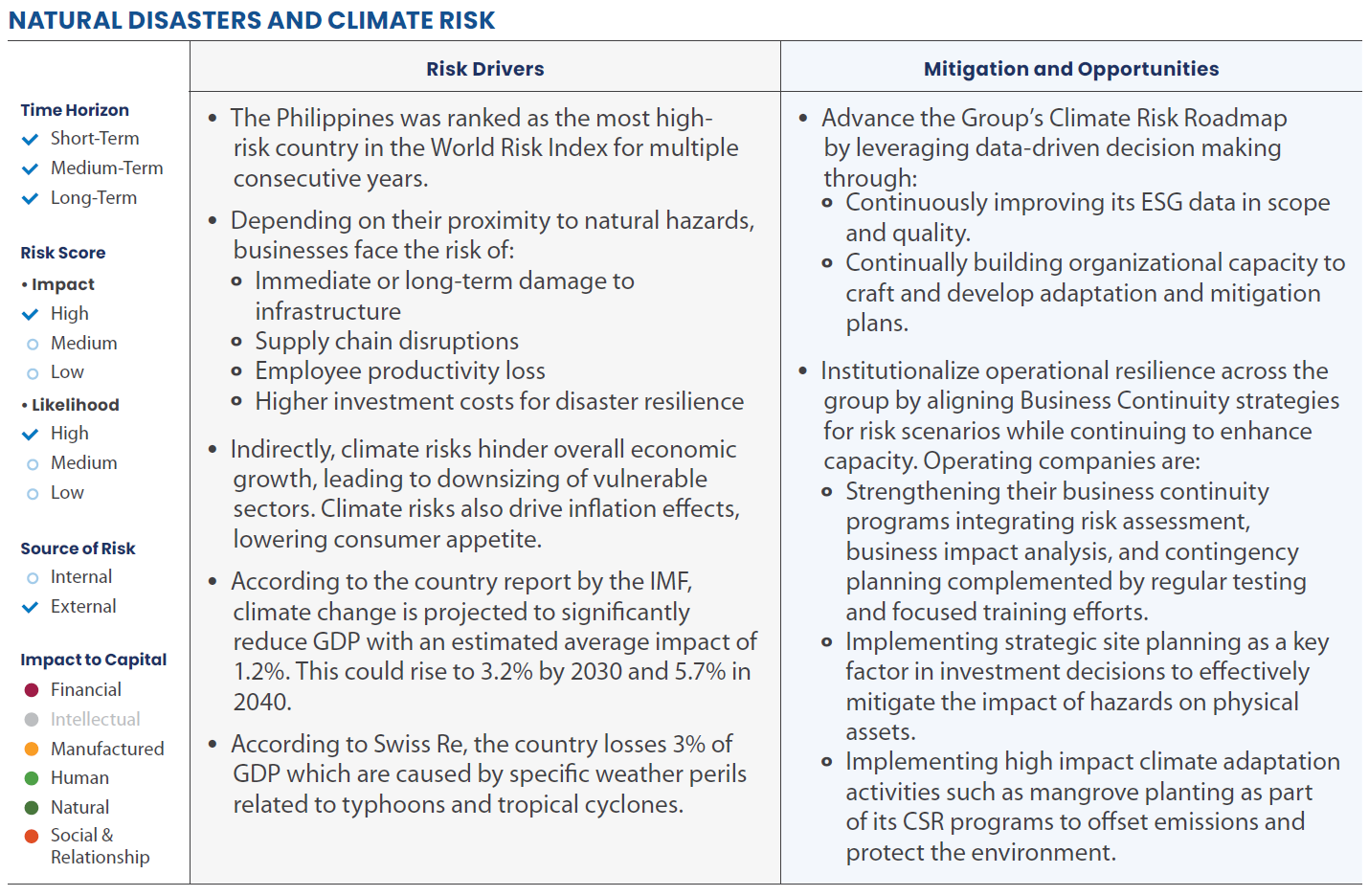

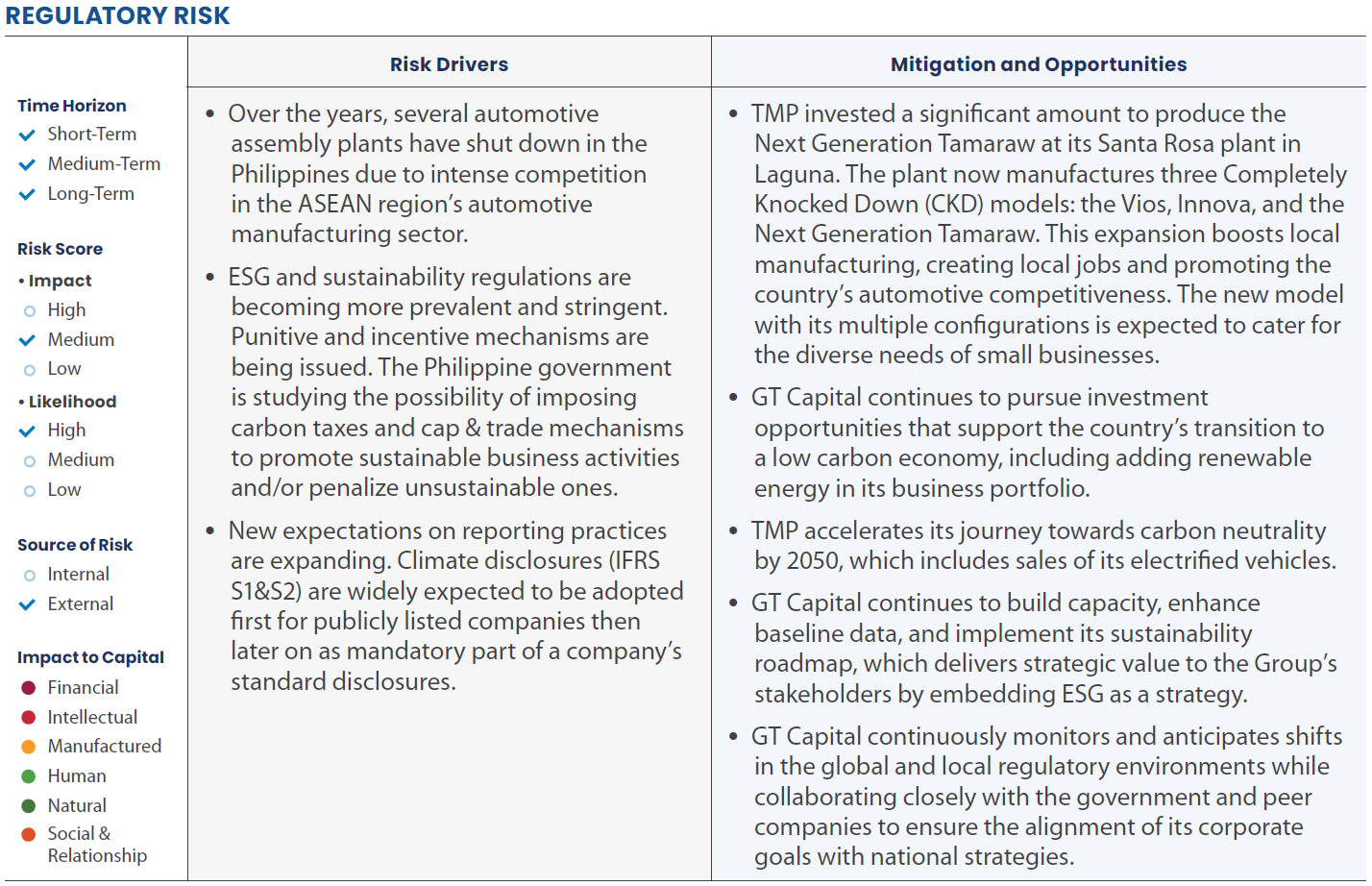

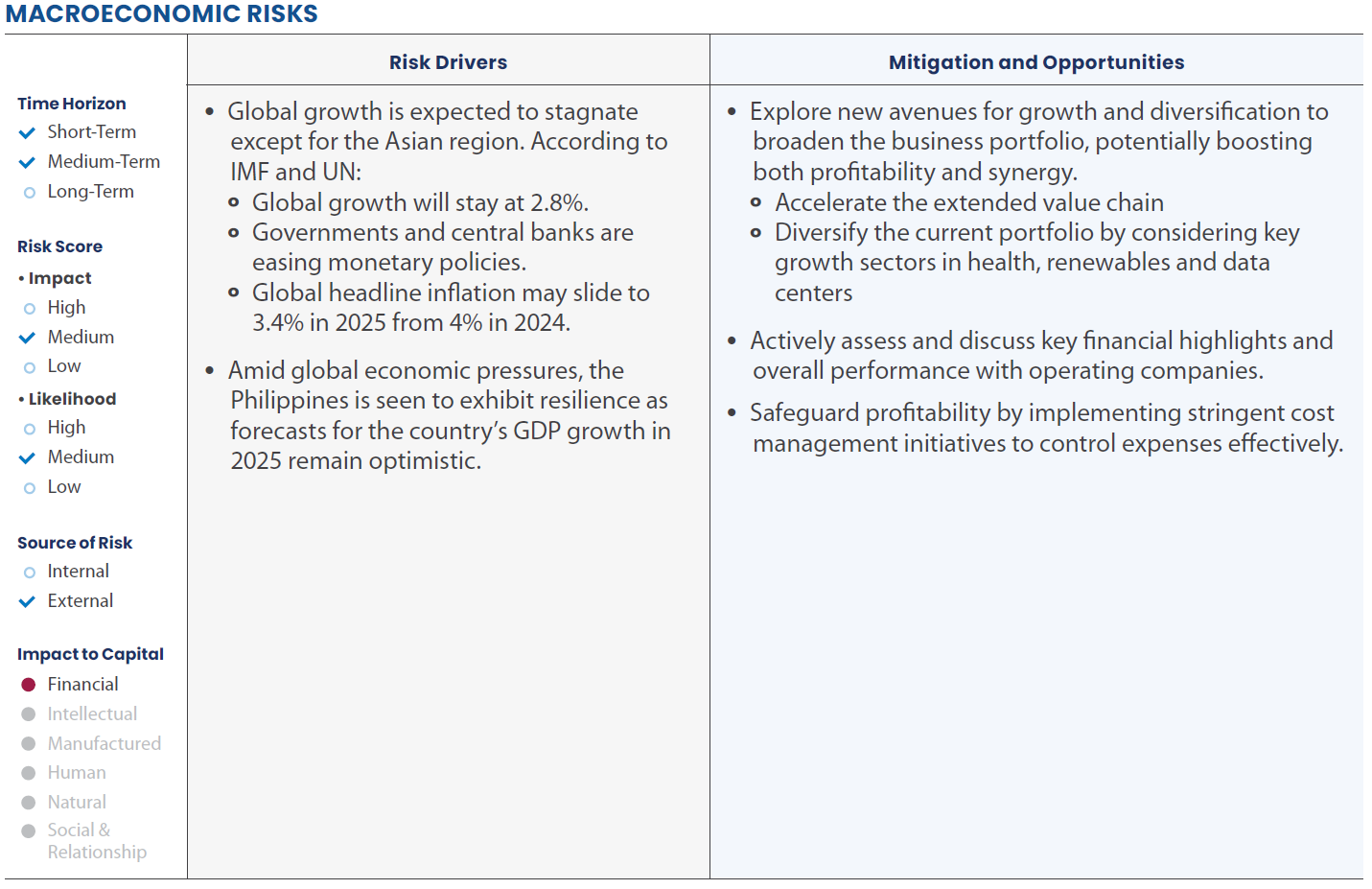

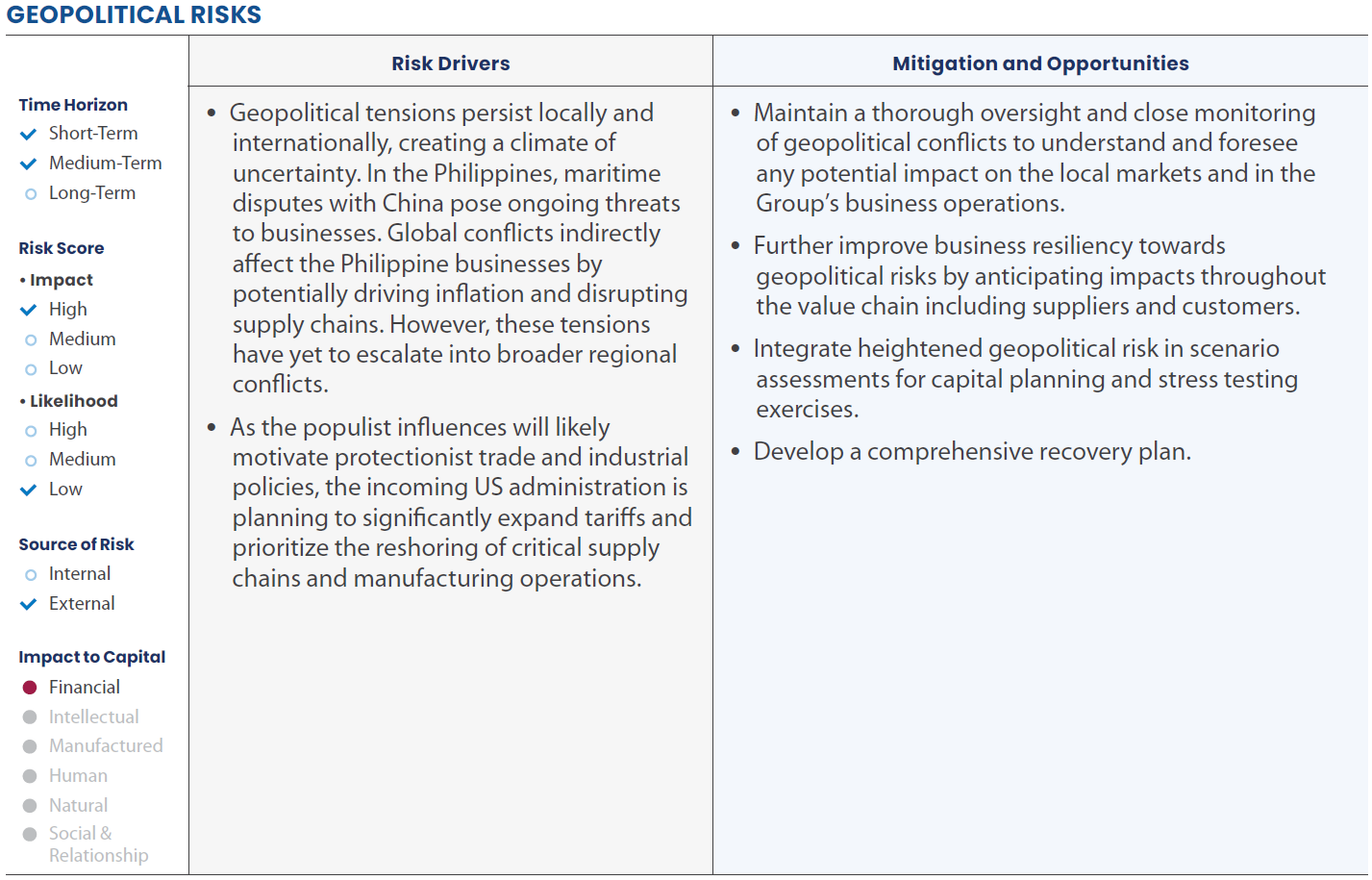

A testament to its strength and resilience, GT Capital identifies, monitors, and mitigates risks that may affect the company’s future performance. The Company has always been proactive in addressing risks, ensuring that it could continue delivering value to stakeholders despite challenges. GT Capital has determined the following risks to be the most relevant to its businesses.

Source: World Risk Index 2024 https://weltrisikobericht.de/worldriskreport/

EMERGING RISKS

GT Capital exercises prudent risk management by monitoring and preparing for emerging risks. The Company classifies risks as “emerging” if they demonstrate two determining characteristics: 1) they arise externally from factors beyond the Company’s control, and 2) trends point to these risks getting increasingly important. Their significant effects may or may not be felt in the next three to five years, but some consequences may already start to manifest. This drives GT Capital to be proactive in addressing these risks.

WORKFORCE DEMOGRAPHIC CHANGE

|

CONTEXT |

OUR RESPONSE |

|

With ongoing changes in the labor market, employers are compelled to develop strategies to retain talent. Rising living costs have driven many workers to seek better opportunities, including overseas, resulting in a local shortage of skilled labor in the country. Meanwhile, the popularity of remote work further expands employment opportunities, intensifying competition. The Philippines is poised to benefit from a young, working-age population for the next decades. However, according to surveyed executives, the fastest-growing job roles by 2030 will likely be influenced by technological advancements such as AI while green and energy-transition roles are also expected to be among the top fastest-growing occupations. In contrast, the fastest-declining roles are projected to include various clerical positions. A survey by the Asian Development Bank revealed that the Philippines could face a significant skills mismatch, potentially affecting millions of workers in the coming years. |

GT Capital has established mechanisms to ensure employee satisfaction and support professional growth. It invests in learning and development, offering programs that foster career advancement. Additionally, the company encourages employees to identify areas for improvement through regular feedback and open communication. |